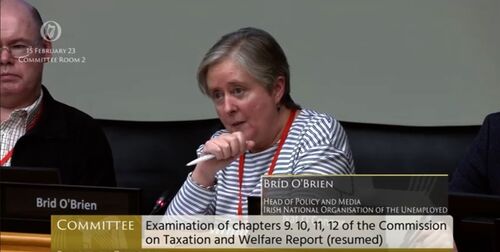

On February 15 th 2023, the INOU made a presentation to the Select Committee on Budgetary Oversight on Chapters nine to twelve of the Commission On Taxation and Welfare (COTW) report. The presentation was based on a submission the organisation had made to the Committee at the beginning of January.

Chapter 9: Promoting Enterprise

The focus and recommendations in this chapter are very much on the tax system. Yet for some people, who experience discrimination or exclusion in the labour market, self-employment can be an important avenue to address their unemployment. The Back to Work Enterprise Allowance (BTWEA) is an important support to facilitate them to do this. The BTWEA runs for two years, but the INOU believes that an additional year should be introduced to support people to make the most of this opportunity with the participant retaining 50% of their social welfare payment in the third year.

Chapter 10: Labour Markets and Social Protection Systems

In this chapter the COTW note “A coherent approach to the design of the taxation and welfare systems will encourage labour force entry, encourage people to take up work, support people in work who are on low pay and facilitate progression from lower to higher earnings.” (p226) The complexity of Ireland’s social welfare system is an issue raised regularly throughout the work of the INOU. This situation, coupled with uncertainty about how the taxation system might impact an unemployed person seeking to move from a welfare payment into work, can make such a move challenging. A challenge that can be exacerbated if the only available work does not have a regular pattern, leading to income uncertainty and insecurity.

Later on in this chapter the COTW note that “Over the past decade, there has been a clear policy of developing the PES in line with international thinking that, for people of working age, social protection systems should be more ‘active’ i.e. provide support to jobseekers finding employment, as well as providing benefits.” (p231) The downside to this approach is that the Public Employment Service becomes more interlinked with certain social welfare payments, in particular Jobseeker’s payments, the only payments to which Genuinely Seeking Work criteria apply. Such an approach does not lend itself to developing a person centred service inclusive of all people of working age, leaving people who are unemployed and not in receipt of a payment or job changers outside of most labour market supports.

On page 246, the COTW notes that “There must be a capacity to respond to greater demand for training and support where people are unemployed due to sectoral decline, where tasks are transferred to automated processes.” This is a challenge that will also arise as Ireland seeks to decarbonise its economy. Over the years, INOU affiliated organisations have noted that as good jobs are lost in their locality, alternative employment too often has inferior pay, terms and conditions. Such a scenario not only throws up difficulties at the personal, familial and communal levels, but it also presents tax and welfare challenges at national level.

Chapter 11: Promoting Employment

On page 265, the COTW states that “ In the world of work, the taxation and welfare systems have considerable influence. Both systems should work to make transitions into the labour force attractive, make Ireland an attractive place for Foreign Direct Investment (FDI), and provide a suitable level of income support when individuals experience unemployment.” Access to good social welfare and employment supports and services is critical, not only for people who are unemployed but, for Ireland’s social and economic development. In a changing world of work, everyone of working age needs to be able to access good information and supports to make informed and sustainable employment decisions.

Section 11.3.5 is entitled The Public Employment Service and in this section the COTW give welcome recognition to the fact that “ Jobseekers are not a homogenous cohort and the requirements of other cohorts may be even more diverse, requiring a range of responses from the PES.” (p276) The development and implementation of these responses must be informed by the Public Sector Equality and Human Rights Duty.

Chapter 12: Inclusive and Integrated Social Protection

The important role played by social protection supports in so many people’s lives is captured in the following quote from this chapter: “For those of working age, social protection systems serve to temporarily replace income lost to periods of, for example, unemployment, injury, disability, sickness, paternity or maternity. In cases where earnings from employment are insufficient to avoid poverty or social exclusion, social protection measures provide a floor below which income will not fall. The social protection system also facilitates participation in employment and provides pathways to restoring people’s earning capacity after any of the above contingencies. The principal economic argument for social protection is the mitigation and sharing of risk across society.” (p288)

On the same page the COTW also noted that “A key function of the social protection system is to act as a safety net for those at risk of poverty. It follows, therefore, that social welfare rates must be adequate in order to effectively provide such a safety net.” A key concern for the INOU is that the issue of income adequacy is properly addressed and that social welfare payments are set at a level that (i) lift people above the poverty line and (ii) supports them to meet a minimum essential standard of living (MESL), which should be informed by the work of the Vincentian MESL Research Centre.

Over the years the INOU has called on the Government to introduce a work-friendly Social Welfare system for Jobseekers reflective of changing work practices, based on hours worked rather than days worked; and to re-introduce pay-related Jobseeker Benefit (JB) payments and restore its duration. On December 7 th , 2022 the Department of Social Protection opened a public consultation on Pay-Related Benefit for Jobseekers and an outline of a Working Age Payment , which is covered in a separate article.

The INOU’s submission to the Committee contains the organisation’s consideration of the COTW recommendations in Chapters ten to twelve. A copy of the full submission can be found ( linked here ).